Navigating the Rise in Car Insurance Rates

Have you recently observed an increase in your car insurance bill? This isn’t an isolated incident. Many are grappling with heightened rates as insurance companies adjust their premiums in response to market shifts throughout 2022 and 2023.

Here’s a closer look at why there’s an uptick in your car insurance expenses:

Reasons Behind the Rise in Car Insurance Rates

Several significant shifts in the market are responsible for the surge in car insurance premiums:

- Heightened Claim Costs: The cost of processing claims has grown, mainly due to:

- More severe insurance claims.

- Rising prices of replacement parts.

- Scarcity of replacement parts.

- A limited workforce in repair shops.

- Extended repair durations leading to prolonged rental car usage.

- Vehicle Shortage: With both new and used vehicles in short supply, replacing totaled cars has become a pricier affair.

- Inflation: The sweeping impact of inflation has also affected insurance costs.

How Much More Will I Pay?

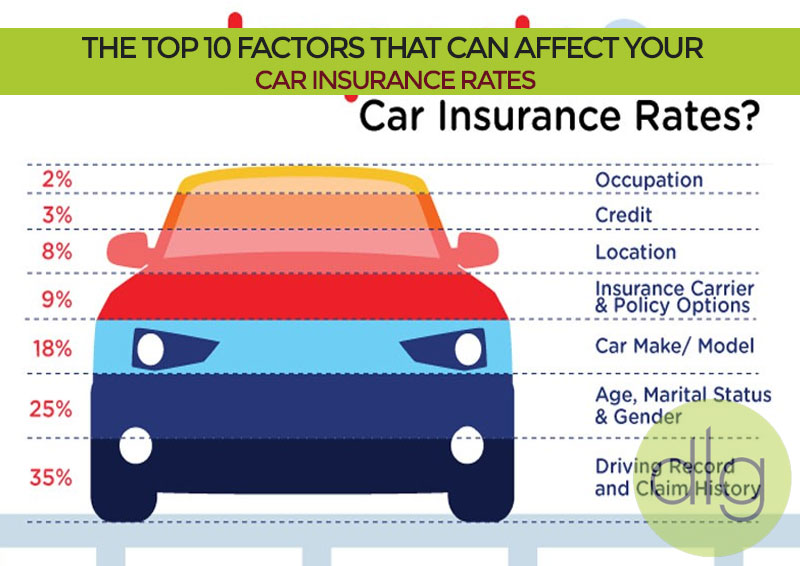

The hike in your car insurance depends on your specific location and policy details. There’s no standard percentage increase across all insurers. Each company adjusts its rates based on the challenges they face and inflation trends. Furthermore, any rate adjustments undergo a review and approval process by the state’s insurance department.

But What If I Haven’t Made Any Claims?

While individual claims can influence your rates, this recent surge in cost is predominantly due to broader market dynamics rather than individual claim histories.

Is Switching Insurance a Good Idea?

While a higher rate might make you consider other insurers, it’s essential to remember that these changes are industry-wide. However, it’s always a smart move to explore. Your Bolder Insurance advisor can guide you in comparing various providers to secure the best deal for your needs.

Before jumping ship, pay attention to aspects beyond just the cost – consider service quality, coverage offerings, and policy limits. With the present challenges in repairs and replacements, picking an insurer solely based on lower rates without considering service quality might backfire during claim times.

Understanding that the current rise in premiums is a reaction to the evolving market conditions over recent years can be frustrating. Yet, these adjustments are essential. For a more in-depth discussion on these changes, don’t hesitate to consult with your trusted Bolder Insurance Advisor.